Online banking has become an integral part of our daily lives, allowing us to conveniently access our finances from anywhere, at any time. As technology continues to advance and consumer behavior evolves, the future of online banking is constantly evolving as well. In this article, we will explore some of the top trends and predictions for the future of online banking.

Increased Personalization

As online

banking becomes more advanced, banks are increasingly

investing in technologies such as artificial intelligence

and machine learning to provide more personalized

experiences for their customers. These technologies can be

used to provide customized financial advice, suggest new

products or services, and even anticipate customer needs

based on their behavior and preferences.

The Rise of Mobile Banking

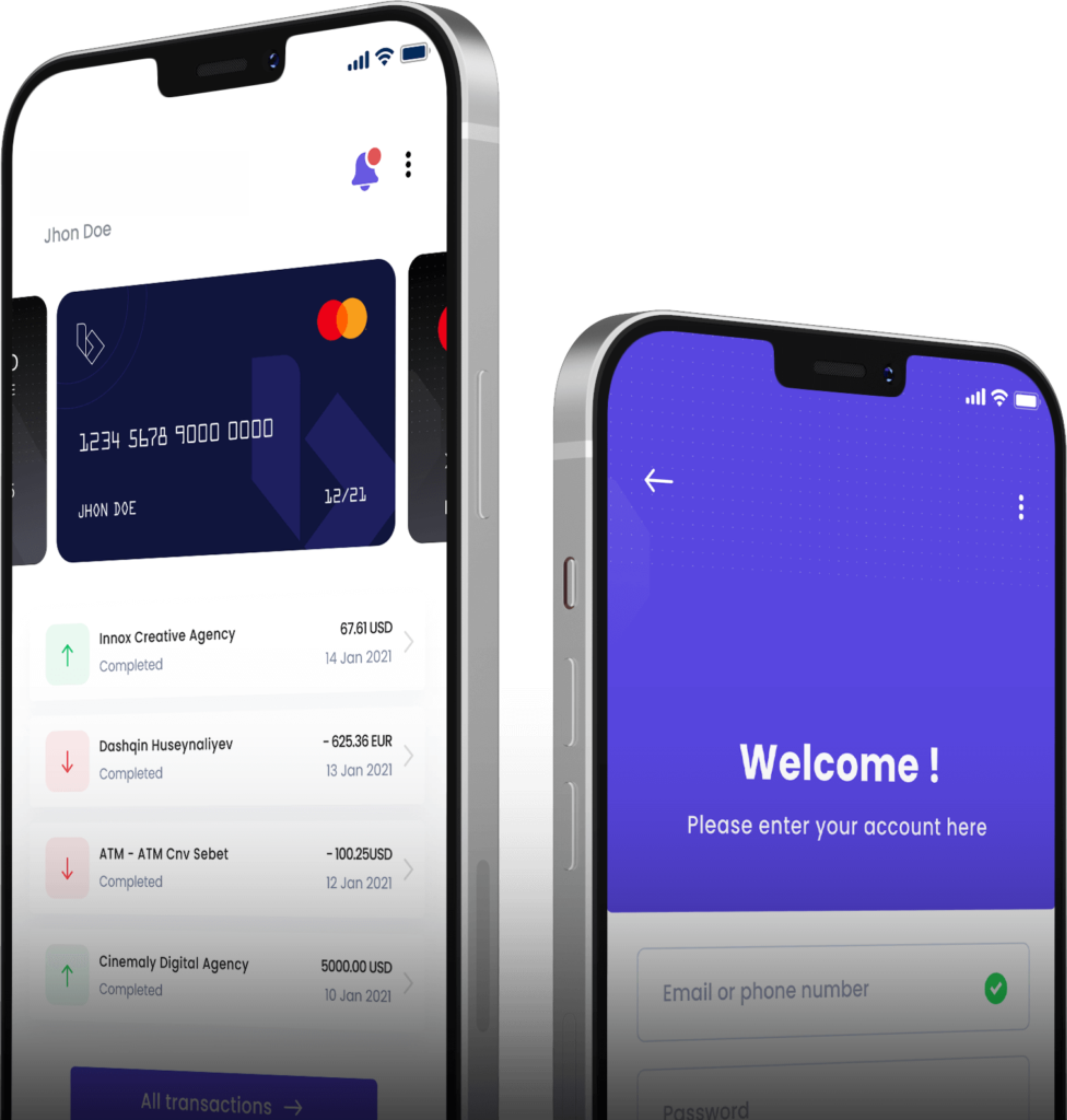

The

mobile phone has become an integral part of our lives, and

as such, mobile banking is becoming increasingly popular.

Customers can check their account balances, transfer

money, and pay bills from their smartphones, making it

more convenient than ever to manage their finances

on-the-go.

Biometric Authentication

Traditional

authentication methods such as passwords and PINs are

becoming less secure, and as a result, banks are turning

to biometric authentication methods such as facial

recognition, voice recognition, and fingerprint scanning

to enhance security. Biometric authentication provides a

more secure and convenient method for customers to access

their accounts.

Integration with Other Services

As

banks continue to expand their digital offerings, they are

also looking to integrate with other services such as

e-commerce platforms and digital wallets. This will allow

customers to seamlessly move between different platforms

and make transactions without leaving their bank’s

website or mobile app.

Increased Emphasis on Financial Education

Financial literacy is becoming increasingly

important in today’s world, and banks are

recognizing the importance of educating their customers on

financial matters. Online banking platforms are

increasingly offering educational resources such as blogs,

videos, and online courses to help customers better

understand their finances.

Virtual Assistants and Chatbots

As

online banking becomes more sophisticated, banks are

turning to virtual assistants and chatbots to provide

customer support. These technologies can be used to

provide quick and efficient customer service, answer

questions, and resolve issues without the need for human

intervention.

Blockchain Technology

Blockchain

technology has the potential to transform the way online

banking operates. By providing a secure, decentralized

ledger for financial transactions, blockchain technology

can increase security, reduce costs, and enhance

transparency in the financial system.

In conclusion, the future of online banking is bright and full of potential. As technology continues to advance, banks will need to continue to innovate and adapt to stay ahead of the curve. By embracing new technologies and offering personalized experiences, banks can provide their customers with the convenience and security they need to manage their finances effectively in the digital age.